Investment loan

With the investment loan, you can invest from day one. The leverage effect of the loan can multiply your return and achieve superior performance compared with a conventional savings strategy.

The benefits

of investment loan

- Deductible interest on non-registered investments

- No margin call loan

- No collateral required

- Tax benefits on disbursement

- Optimum strategy for real estate investors

- Preserve your savings for other types of investment

- No-down-payment financing

Invest now with solid financial institutions

- In terms of investment portfolios, we offer MAWER, Dynamic, Fidelity and Blackrock funds.

- We work in partnership with IA Financial Group, National Bank, Manulife Bank and B2B Bank for financing.

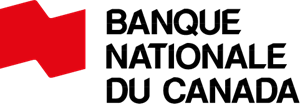

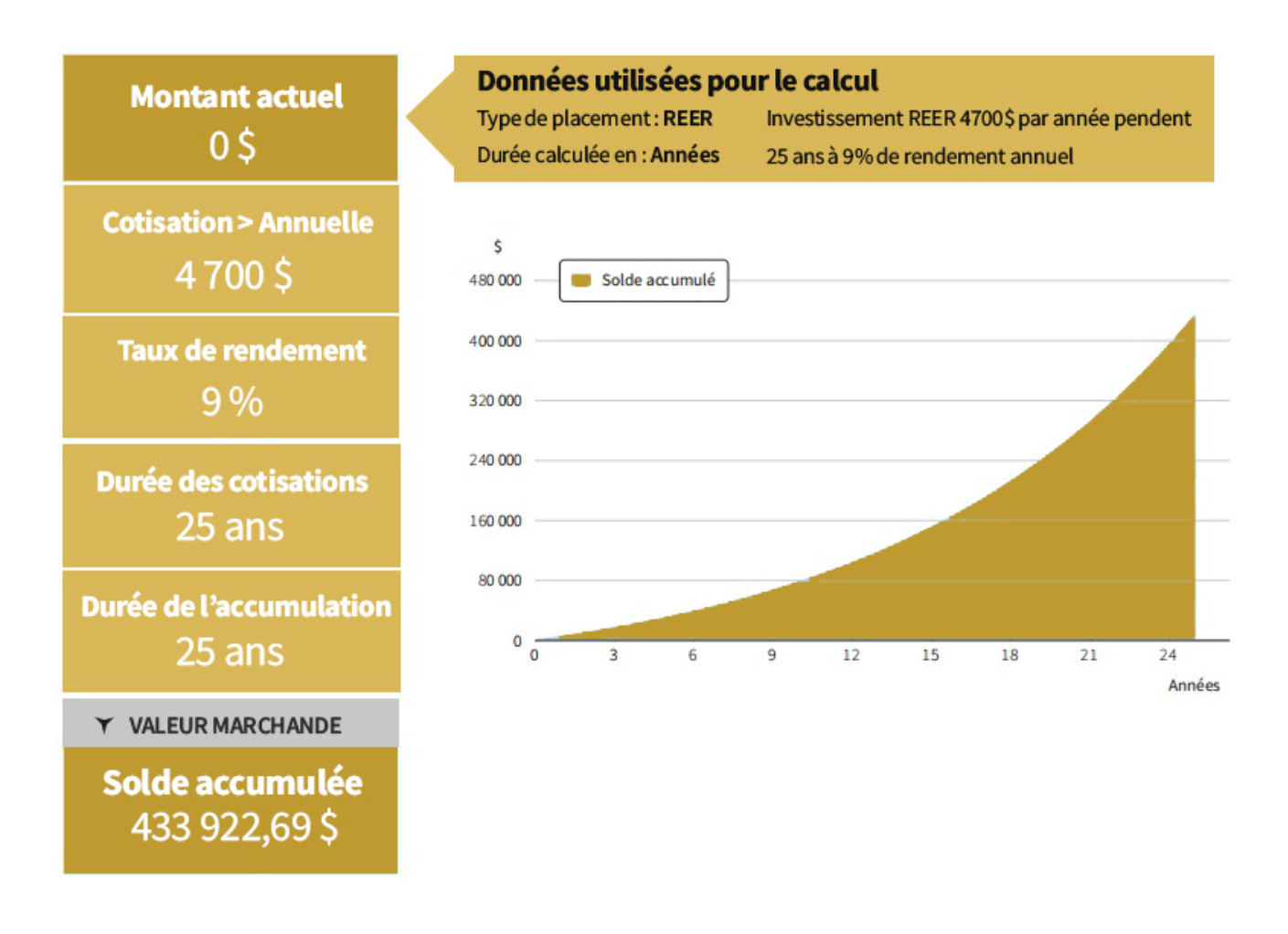

Comparative study

TRADITIONAL SAVINGS

INVESTMENT LOAN

For the investment loan example, we have projected an annual interest payment of $4700, corresponding to a prime rate of 3.95%+0.75%. Bear in mind that in this example, if interest rates rise, this will have an impact on the profitability of the investment loan.

Note: It’s important to remove the $100,000 initially borrowed, so the result for the loan is $762,000.

When disbursed, the investment loan will be taxed as a capital gain, so you pay half as much tax as an RRSP, which is added directly to your 100% taxable income.

Advice according to

Your needs

A 30-minute appointment to answer all your questions!

Is this strategy right for you ?

- You are comfortable with risk

- You have no fear of taking out a loan to buy securities whose value may go up or down

- You invest for the long term

You shouldn't borrow to invest if:

- Your risk tolerance is low;

- You invest for the short term

- You intend to use the income from your investments to pay your living expenses or repay your loan

- If this income stops or decreases, you may not be able to repay your loan.

You could loose some money :

- If you have borrowed to invest and your investments lose value, your losses will be greater. than if you had invested your own funds.

- Whether or not your investments are profitable, you will still have to repay your loan and the interest.

- Even if the value of your investments increases, you may still not realize sufficient gains. to pay off your loan.

- Should the investment decrease by more than 20%, an additional principal repayment of $417 per month will be added to the monthly payment for each $100,000 loan.

The implementation of an investment loan strategy is carried out by our licensed financial security advisors. Investment will be made in a segregated fund account

Get advice from our advisors

A free, no-obligation meeting!

- 9:00 - 16:00

- Closed